Welcome to Complete Financial Centre

Mortgage & Protection Adviser

How can we help?

Our Services

We offer a full range of mortgage and protection services. See below for some of our most popular.

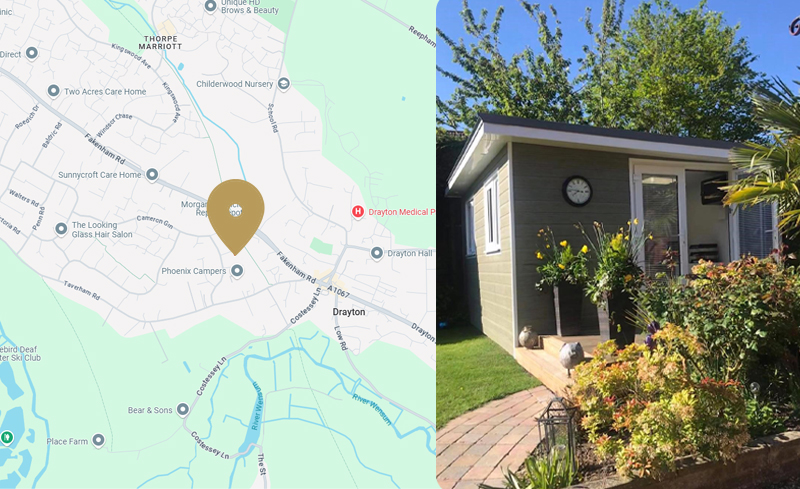

Mortgage & protection advisers located in Norwich

Mortgage & protection advisers located in Norwich

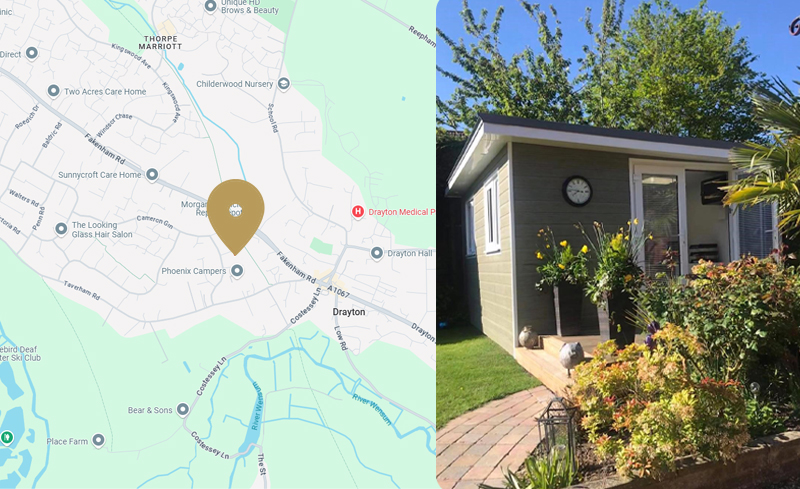

Welcome to Complete Financial Centre

Contact us now and see how our friendly service and know-how can help ensure you get the right mortgage to enable the purchase of a new home, a property to let or simply to re-mortgage your existing property.

A mortgage is a large financial transaction and we are here to make sure you get it right and help ensure the process runs smoothly and efficiently.

As mortgage brokers we have access to a comprehensive range of UK mortgages and re-mortgage products from many different lenders across the market. Once we understand your individual circumstances and needs, we will be able to research the mortgage market and recommend the most suitable mortgage deal for you. As part of our service, we will deal with the lender on your behalf, taking the stress out of the process for you.

We can also help ensure you have the right insurance and protection in place to cover you and your home.

So, if you are looking for a mortgage, please call us today on 01603 901520 or email us at tina@completefc.com and we'll be pleased to help you.

Cycle of Life

Cycle of Life

Cycle of Life

The cycle of life usually starts with you buying your first home or having a child. As everyone’s circumstances change their cycle of life begins to evolve along side the need for protection becomes more important. This is where we can help you through this journey.

SOLUTIONS FOR YOU

Our Main Services

CAN WE HELP YOU WITH SOMETHING?

Request a Call Back

TESTIMONIALS

See What Our Clients Have to Say About Us